Millions of people live with the daily struggle of managing pain. Research shows that CBD oil, a natural remedy, may offer relief where traditional medications fall short.

This article dives into how CBD can ease different types of discomfort, including joint and nerve pain.

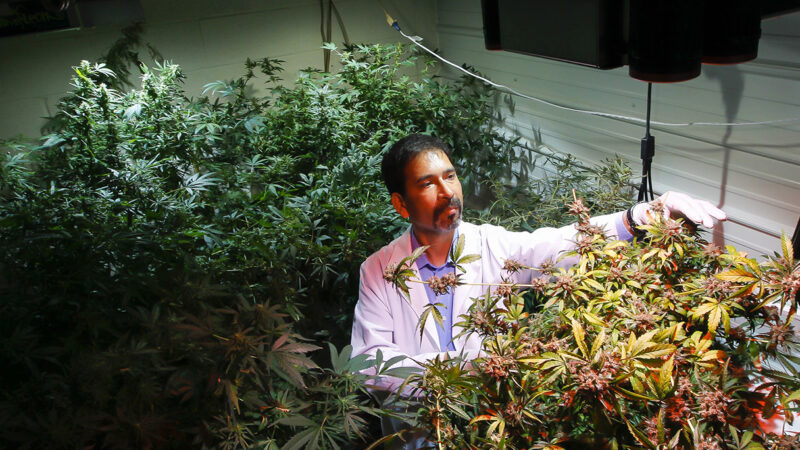

CBD for Pain Management

CBD has been studied for its potential to help with chronic pain, arthritis and joint pain, as well as neuropathic pain. It is essential to explore the potential benefits and effects of CBD oil for these specific types of pain Zen Bliss CBD.

How CBD may help with chronic pain

CBD, short for cannabidiol, is making waves in the world of chronic pain management. Unlike its cousin THC, CBD doesn’t cause a high but may offer relief for various types of persistent discomfort.

Studies suggest that CBD can reduce inflammation, a common culprit behind chronic pain. It seems to interact with the body’s endocannabinoid system—a network influencing pain and inflammatory responses—and by doing so, it could help ease long-lasting aches.

Many people struggling with conditions like fibromyalgia or arthritis turn to CBD oil as a natural alternative to traditional medicines. Its potential anti-inflammatory properties make it an appealing option for those hoping to relieve joint pain without the psychoactive effects associated with other cannabis compounds.

As research continues to grow around cannabidiol and its health benefits, more individuals are considering it a viable component of their holistic treatment plan. Moving on from how CBD assists with unpleasant chronic sensations, let’s delve into its specific impacts on arthritis and joint discomfort.

Potential benefits for arthritis and joint pain

CBD oil may offer potential benefits for arthritis and joint pain. Research suggests CBD’s anti-inflammatory properties could help reduce inflammation, easing arthritis-related discomfort.

CBD may also alleviate joint pain by interacting with receptors in the endocannabinoid system, potentially relieving chronic or acute pain associated with various joint conditions.

Many individuals report experiencing reduced pain and improved mobility after using CBD oil for arthritis and joint issues. CBD oil’s ability to modulate the body’s inflammatory response is believed to play a significant role in managing these symptoms.

Effects on neuropathic pain

CBD oil has shown potential in providing relief from neuropathic pain, which originates from nerve damage. Studies suggest that CBD may help manage this type of pain by interacting with the endocannabinoid system to reduce inflammation and alleviate discomfort.

Its ability to modulate neurotransmitters and provide neuroprotective effects could also contribute to its effectiveness in reducing neuropathic pain symptoms.

Further research is necessary to fully understand the mechanisms behind CBD’s impact on neuropathic pain. Still, early findings are promising for those seeking alternative methods for managing this type of chronic discomfort.

Using CBD for Pain Relief

“Considerations for dosage and potential side effects should be taken into account when using CBD for pain relief. The current state of research on CBD’s effectiveness for pain management, as well as its other potential benefits and uses, is also worth exploring.”.

Considerations for dosage and side effects

CBD dosage varies depending on the individual and the condition being treated. It is advisable to start with a low dose and gradually increase it until the desired effects are achieved, as CBD affects people differently. Potential side effects of CBD may include fatigue, diarrhea, changes in appetite, and weight fluctuations. It’s essential to consult a healthcare professional before beginning CBD treatment, especially if you are taking other medications or have underlying health concerns. Identifying a reputable source for CBD products is crucial to ensure quality and safety. Research into CBD’s effectiveness for pain management continues to evolve, shedding light on its potential benefits and limitations.

The current state of research on CBD for pain management

Current research on CBD for pain management shows promising results. CBD may help reduce chronic pain by interacting with neurotransmitters and reducing inflammation.

Research has also suggested potential benefits of using CBD for arthritis and joint pain, as well as its effects on neuropathic pain. Additionally, ongoing studies are exploring the use of CBD in managing fibromyalgia symptoms and its potential to alleviate anxiety related to chronic pain.

Clinical trials and scientific investigations have been conducted to assess the effectiveness of CBD for pain relief. Researchers are also examining the impact of different dosages and any associated side effects.

Other potential benefits and uses for CBD.

Expanding beyond pain management, CBD has shown potential in alleviating symptoms of anxiety and depression. Studies suggest that CBD may interact with serotonin receptors in the brain, which could help regulate mood and emotional responses.

Additionally, emerging research indicates that CBD may have anti-inflammatory properties, making it a potential complementary treatment for conditions such as acne and inflammatory skin disorders like eczema.

Furthermore, ongoing studies are exploring the effects of CBD on neurological disorders such as epilepsy and Parkinson’s disease. Early findings show promise in reducing the frequency and severity of seizures in some epilepsy patients.

Conclusion

In conclusion, CBD oil shows promise in managing various types of pain, including chronic pain and arthritis. Research suggests that it may help reduce inflammation and relieve neuropathic pain.

Considering the potential benefits and the current state of research, CBD could be a valuable alternative for individuals seeking non-psychoactive pain management options. Its potential to address other conditions like anxiety and seizures also makes it an exciting area for further exploration.